Expense Ratios Explained

I got a question last week asking if I could explain expense ratios. If you invest in index funds, mutual funds, or ETFs, you should probably read this.

They all charge fees (expense ratios) for running the fund. Passive funds (those that track an index like the S&P 500) charge much smaller fees. There’s just … not a lot to do. Buy the stocks that are in the S&P500. Done.

But there are also actively managed funds where a real live human … actively manages the fund. They buy stuff, they sell stuff. They’re always tweaking the portfolio.

As a long term investor, you might decide you’re more comfortable with a broad market S&P500 index fund than putting your faith into an actively managed fund. What if they pick wrong? Or … if you’re a diversified investor, you might decide you want to be heavily invested in a broad market S&P500 index fund and then toss a little into an actively managed fund for funsies.

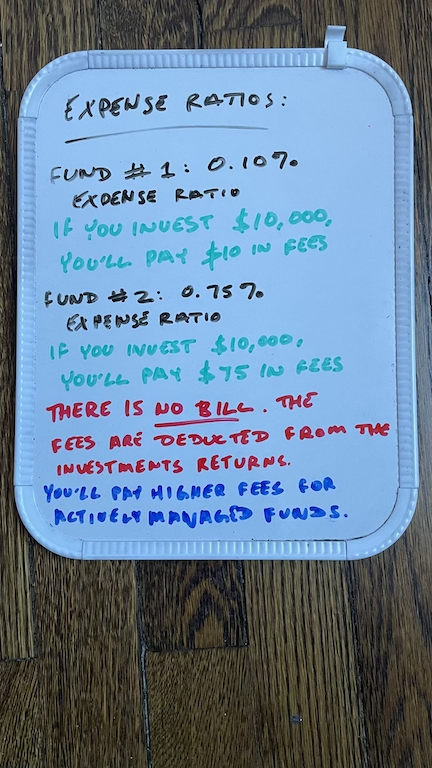

If you’re a small investor, the fees won’t kill your account, and if you’re a large investor, as someone politely pointed out on my TikTok video, you probably don’t care that you’re spending $2000 a year in fees. But, here’s what it looks like: